Introduction

Honestly, it’s wild how everything’s gone digital—shopping, bill payments, you name it. If you’re hustling with a business in India, whether it’s a tiny side gig or you’re aiming for unicorn status, you really can’t dodge what the Reserve Bank of India (RBI) has to say about online payment gateways. Pretend their rules don’t exist? Yeah, that’s just asking for headaches.

Think of the RBI’s guidelines as your business’s guardian angel mixed with a super-strict schoolteacher. They keep the fraudsters away and also make sure you’re not winging it with your customers’ money. And with everyone glued to their phones, paying for stuff online, following these rules isn’t just a “nice-to-have”—it’s 100% necessary if you want people to trust you and your business to stick around. So, yeah, friendly tip: get cozy with those RBI guidelines. They’ll save your skin and help you build something that actually lasts.

Overview of RBI Guidelines for Online Payment Gateways

Understanding the structure and purpose of RBI’s digital payment regulations is the first step to compliance. These guidelines are not just rules—they’re a framework built to secure India’s digital financial infrastructure.

Scope & Objectives

RBI’s guidelines apply to all payment aggregators, gateways, banks, and fintech companies operating in India. Whether you handle transactions directly or support platforms that do, these rules are mandatory.

- Ensure consumer data protection and transaction security

- Build trust and accountability among payment intermediaries

- Standardize practices across platforms for stability

Definitions & Key Terms

The Reserve Bank uses specific terminology, which is vital for interpreting the framework correctly:

- Payment System Operator (PSO): Entity authorized to operate a payment system

- Participant: Any party involved in payment processing (e.g., merchants, banks)

- End-user: The customer or payer using the service

Timeline of Major Updates

RBI’s oversight on digital payments has evolved over the years. Key regulatory milestones include:

| Year | Guideline | Impact |

|---|---|---|

| 2009 | Initial Payment System Vision Doc | Introduced regulatory oversight |

| 2017 | Data Localization Mandate | All payment data must reside in India |

| 2021 | Revised Guidelines for PAs | Introduced licensing and KYC norms |

These updates reflect RBI’s shift toward tightening security, improving transparency, and scaling with digital adoption.

Key Compliance Requirements Under RBI Guidelines Online Payment Gateway

Staying compliant with RBI’s framework isn’t just about ticking boxes—it’s about protecting users and maintaining credibility. Sure thing! Here’s your text with a friendly, laid-back vibe:

Let’s be real—payment gateways can’t just do whatever they want. They’ve got to keep things above board, make sure everyone knows what’s up, and keep the tech running smooth. No one wants a sketchy checkout, right?

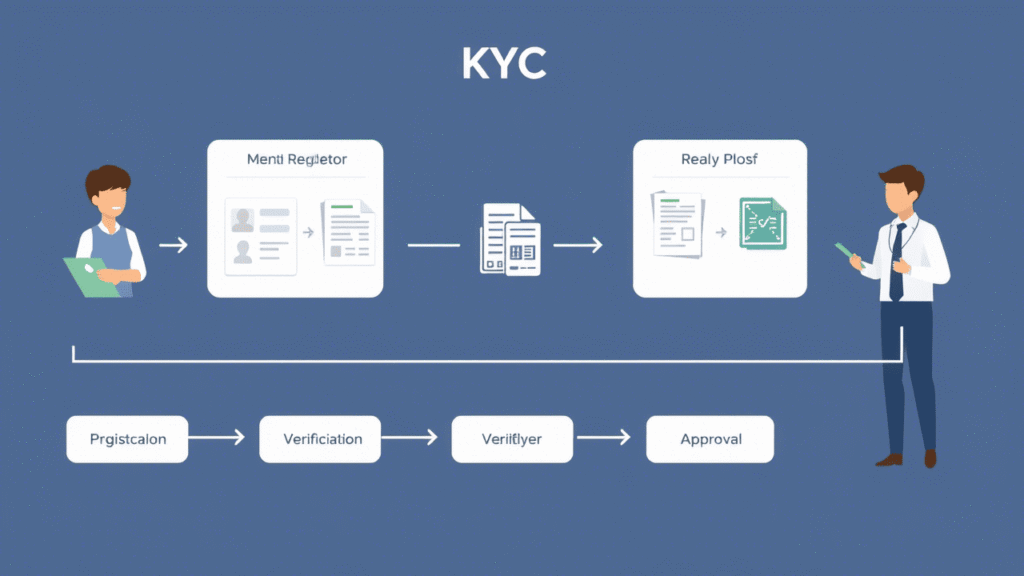

Customer Due Diligence & KYC

So, before you even get started, they’ve gotta check who you are. No sneaky business! That’s where KYC (Know Your Customer) comes in. You’ll probably have to show some ID, maybe snap a quick selfie—nothing too wild, just making sure you are who you say you are. It’s a bit of a hassle, but hey, that’s how they keep things safe and everyone happy.

- KYC is mandatory for all merchants onboarded onto a payment platform.

- Basic KYC involves ID proof and address verification; enhanced due diligence may be required for high-risk users.

- For example, a small clothing seller on a marketplace must submit Aadhaar and PAN details before receiving payments.

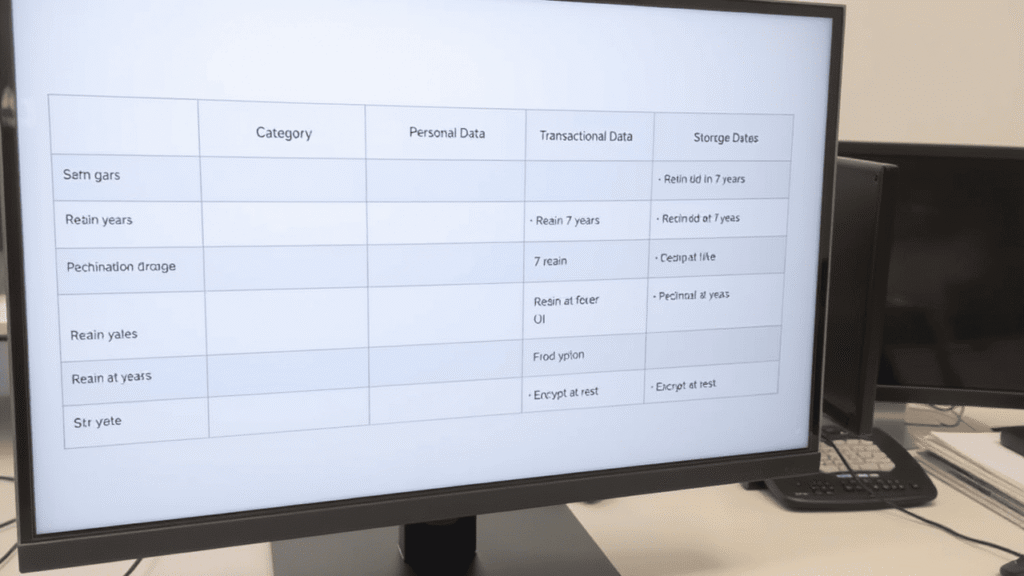

Data Localization & Storage Rules

To protect sensitive data, the RBI mandates that all transaction-related information be stored within India.

- Full end-to-end transaction data must remain within Indian borders.

- Backup and mirroring on offshore servers are not permitted.

- Non-compliance may lead to penalties or cancellation of the operator’s license.

| Data Type | Must Be Stored in India? |

|---|---|

| Card Numbers | ✅ Yes |

| Customer Contact Info | ✅ Yes |

| IP Address | ✅ Yes |

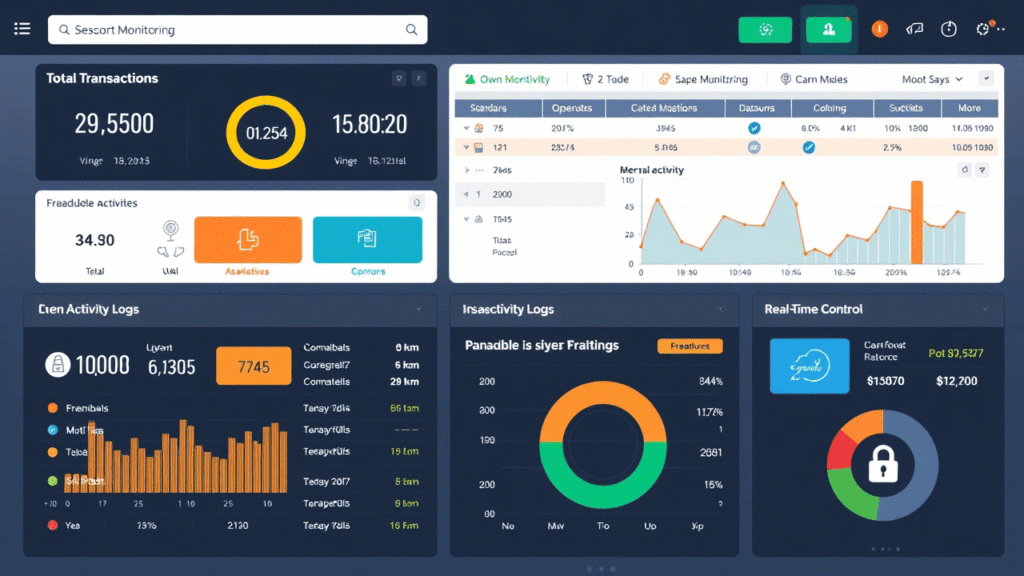

Security & Transaction Monitoring

Look, online payment gateways really have to play by the rules when it comes to security—it’s just how it is. Sticking to things like PCI DSS and ISO 27001, yeah they sound super official, but honestly, they’re there to keep your info safe. So, as long as they tick those boxes, you can chill knowing your data’s not going on any wild adventures!

- So, as long as they tick those boxes, you can chill knowing your data’s not going on any wild adventures!

- Gateways must implement real-time fraud monitoring and alert systems.

- Example (pseudocode):

if (transaction.amount > daily_limit) {

flag("High-risk transaction");

notify("Risk Team");

}

Interoperability & Settlement Cycles

Payment gateways must enable smooth interaction between systems and adhere to RBI’s mandated settlement timelines.

- Gateways should integrate with networks like NPCI to ensure seamless interoperability.

- Settlements must occur within T+1 or T+2 business days, depending on the transaction type.

- FAQ: “Can PSPs settle hourly?”

Answer: No. RBI mandates daily or bi-daily settlement cycles depending on the category of provider.

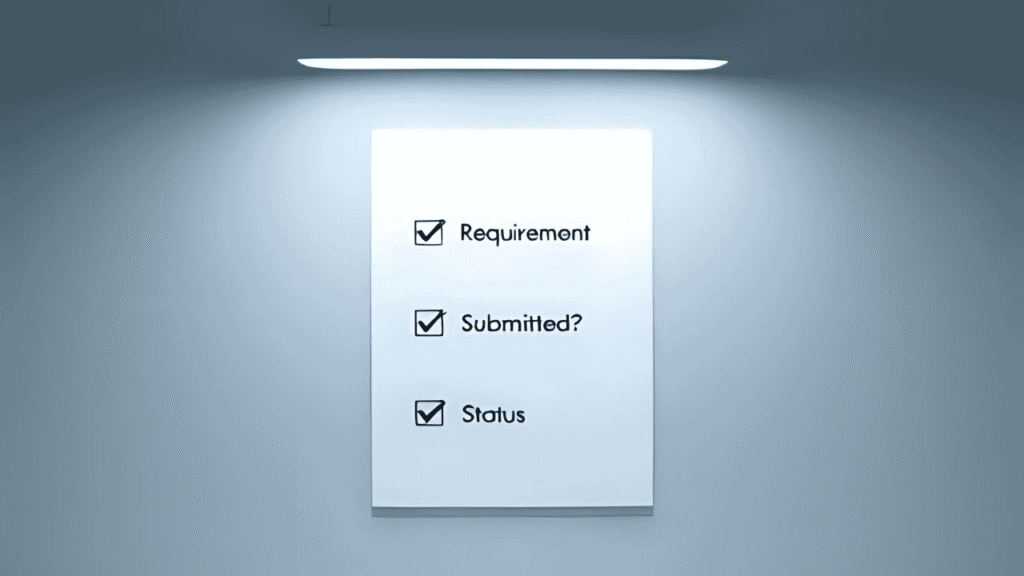

Step-by-Step Implementation Checklist for Payment Service Providers

Getting RBI-compliant isn’t just about policies—it’s about executing each step the right way. If you’re a Payment Service Provider (PSP), this checklist ensures you stay aligned with RBI’s expectations from day one.

Pre-Approval & Registration

Before launching any services, PSPs must register with RBI and secure the necessary approvals.

- Submit an application under the Payment and Settlement Systems Act, 2007.

- Include business plans, financials, IT systems architecture, and compliance frameworks.

- Approval can take several weeks, depending on RBI’s assessment.

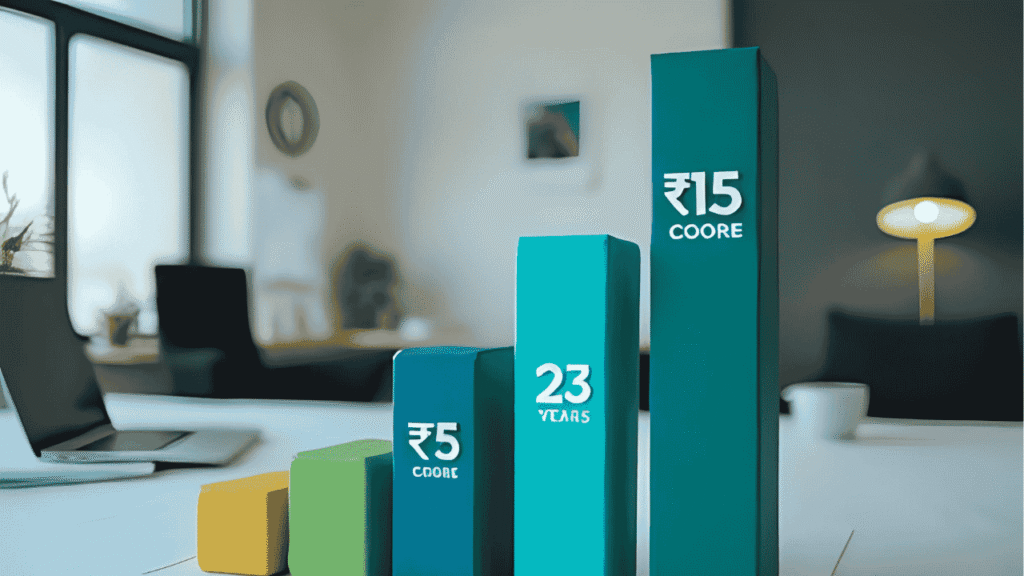

Capital & Operational Requirements

RBI enforces strict financial prerequisites to ensure only serious players enter the market.

- PSPs must maintain a minimum net worth of ₹15 crore initially, increasing to ₹25 crore within 3 years.

- Funds must be verifiable and free from encumbrances.

- Real-world example: A fintech startup raised funds through a seed round to meet the net worth threshold before applying.

Technology & Infrastructure Setup

Technical readiness is essential to meet both compliance and customer expectations.

- Implement secure APIs for integrations with banks and merchants.

- Ensure systems support data localization, encryption, and high uptime.

- Follow best practices in network security, audit logging, and vulnerability scanning.

Ongoing Reporting & Audits

After launch, compliance doesn’t stop—RBI expects ongoing reporting and periodic checks.

- Submit quarterly statements, KYC reports, and performance metrics.

- Get an annual audit done by a CERT-IN certified auditor.

- FAQ: “What triggers an RBI audit?”

Answer: Discrepancies in reports, user complaints, or suspected non-compliance.

Conclusion

The digital economy in India is thriving, but with growth comes responsibility. For any payment gateway or service provider, following the RBI guidelines online payment gateway isn’t just about legal compliance—it’s about earning user trust, securing transactions, and future-proofing your business.

From data storage to KYC, security to settlement cycles, RBI’s framework provides a clear path. By taking a step-by-step approach, PSPs and fintech companies can avoid penalties, ensure transparency, and deliver a seamless user experience.